Staffing

While the rate at which companies expected to increase permanent staffing grew during the first half of 2021, companies became more cautious from August through October 2021 over concerns of impacts from the Delta variant. Growth expectations returned starting in November and December 2021 prior to widespread concerns about Omicron.

Throughout the pandemic, plans for temporary and contract staffing have been more variable than those for permanent staffing. Most of the change in expectations for temporary and contract staffing were shifts from increased and decreased expectations. This variability is to be expected given the inherent flexibility the temporary labor provides and the ability for companies to adjust to changing conditions. In general, more companies were expecting increased temporary and contract staffing than decreased staffing through late 2020 and into 2021, at which expectations became steady with 10% expecting decreases and 20% expecting increases in temporary staffing. The increased stability in permanent staffing in late 2021 is reflected with a commensurate decrease in temporary staffing expectations at the same time. By December 2021 permanent and temporary / contract staffing level expectations began to resemble pre-pandemic expectations from February 2020.

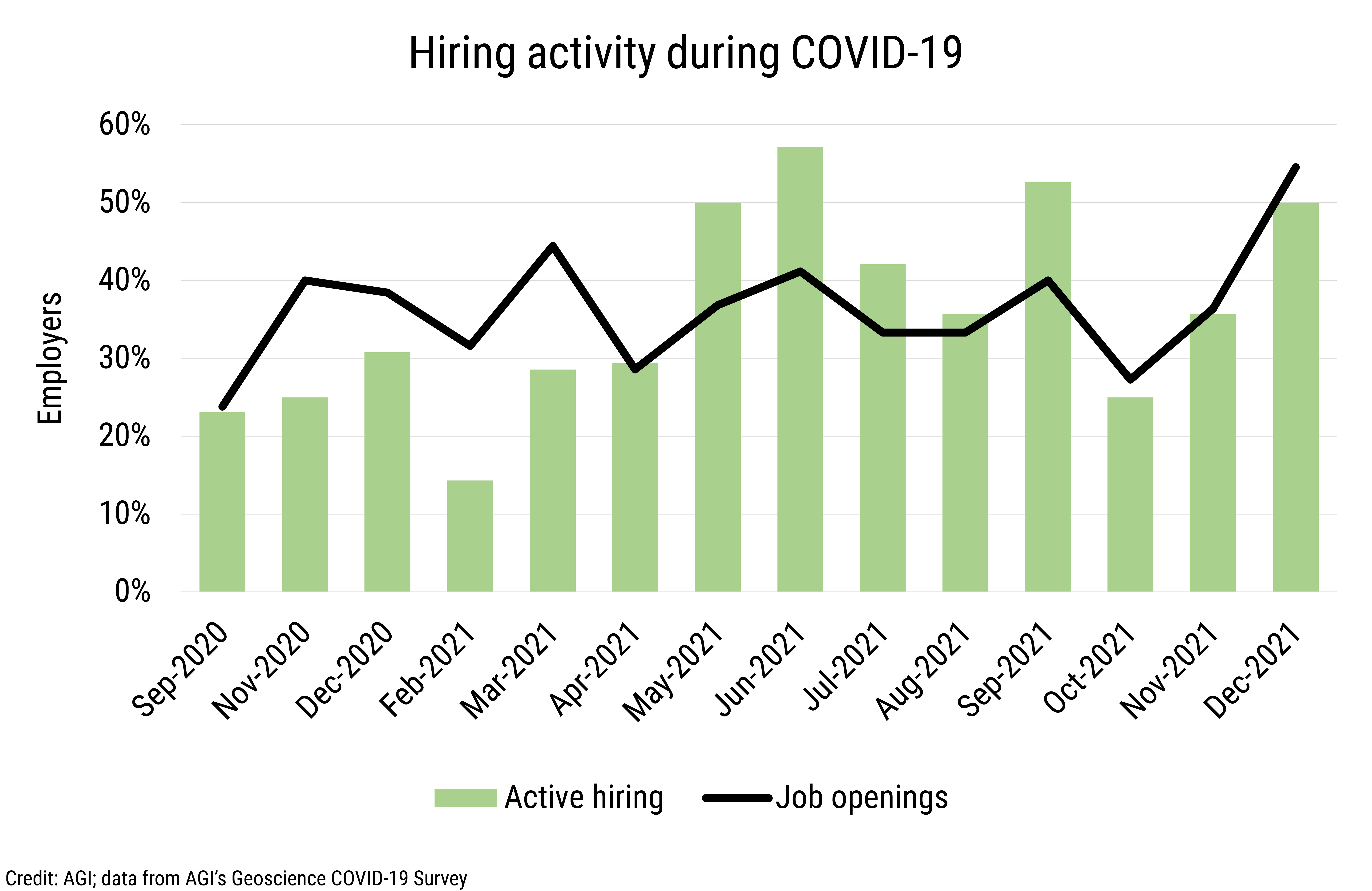

Pandemic-related staffing impacts such as layoffs, furloughs, and reductions to benefits and salaries declined steadily through 2020 and into early 2021 with a temporary peak in March 2021 timed with the end of PPP loan coverage for many employers. As layoffs and furloughs declined through 2021, the proportion of employers reporting hiring freezes increased and remained steady at around 10% of employers for the last half of 2021. Active hiring picked up in Fall 2020 and accelerated through Summer 2021 but faded with the increasing impacts of the Delta variant, only to pick up again by the end of 2021.

Travel and Workplace Policies

Throughout 2020 and 2021, at least half of employers reported their employees were travelling or working in the field. From June 2020 through March 2021, more employers had travel and field restrictions than did not. Since March 2021, substantially more employers have had no restrictions on travel and field work than do, with only 17% reporting restrictions in December 2021.

The proportion of employees travelling or conducting fieldwork declined from 61% in June 2020 to 39% in December 2021. A primary driver for not traveling or conducting fieldwork has been employees’ decisions not to do so. The prevalence of institutional policies preventing travel and fieldwork declined through 2020, with a peak in February 2021 that corresponded with an increase in governmental policies. Although institutional and governmental prohibitions diminished through 2021, the percentage of employers reporting employees not travelling or conducting fieldwork due to personal decisions persisted, ranging from 47% in May 2021 to 20% in November 2021.

While in-office work increased through 2020 with the re-opening of business activities, the percentage of employers offering remote work options declined only slightly. By the end of 2021, 78% of employers offered in-office work options, 91% offered remote work, and over three-quarters of employers offered remote-first work policies (i.e., employees having the option to choose their work location). Access to field sites and labs also increased through 2020 with easing of facility restrictions, and by December 2021, 78% of employers allowed for field activities and site visits and 43% provided lab access. The lower percentage of employers offering lab access is reflective of the limited number of companies with lab facilities.

The largest changes seen in workplace policies was in the types of remote and in-office work approaches as employers have increased work option flexibility. In February 2020, 57% of employers offered only permanent in-office attendance, and this percentage decreased to 22% by December 2021. Over the same period there was an increase in employers offering limited in-office work and both permanent and in-office work options. By December 2021, 22% of employers offered limited in-office work options and just over one-third offered both permanent and in-office work options.

Remote work policies changed in a similar though less dramatic way. The percentage of employers offering both permanent and limited remote work options increased from 14% to 30% between February 2020 and December 2021, whereas those employers offering only permanent or limited remote work options declined from 29% to 26% and 39% to 35% respectively.

Although remote work continues to be the primary environment for employees, employee distribution across work environments has diversified during the pandemic and has adjusted in response to the pandemic situation. In July 2021, employees worked across a wide array of environments, with remote work and full-time office being the top work locations. With the spread of the Delta variant, by October 2021, the distribution of employees shifted away from in-office environments and back to remote work environments.

In August 2021, over half of employers indicated that they were re-evaluating workplace policies and this percentage dropped to 20% by October but increasing again to 50% by the end of the year. Office policies under evaluation included work-from-home criteria, strategies for managing in-office and remote work with regards to vaccination status, mandates vs. incentivization for vaccines, and potential office closures depending on the impacts of the Delta and Omicron variants. By December 2021, employers mentioned that they were evaluating when and if to have employees return to the office, including the frequency of required in-office attendance. Some employers indicated they were re-considering the need for permanent office space given positive remote work experiences. Employers also were re-evaluating masking, social distancing, and testing policies with regard to the spread of the Omicron variant.

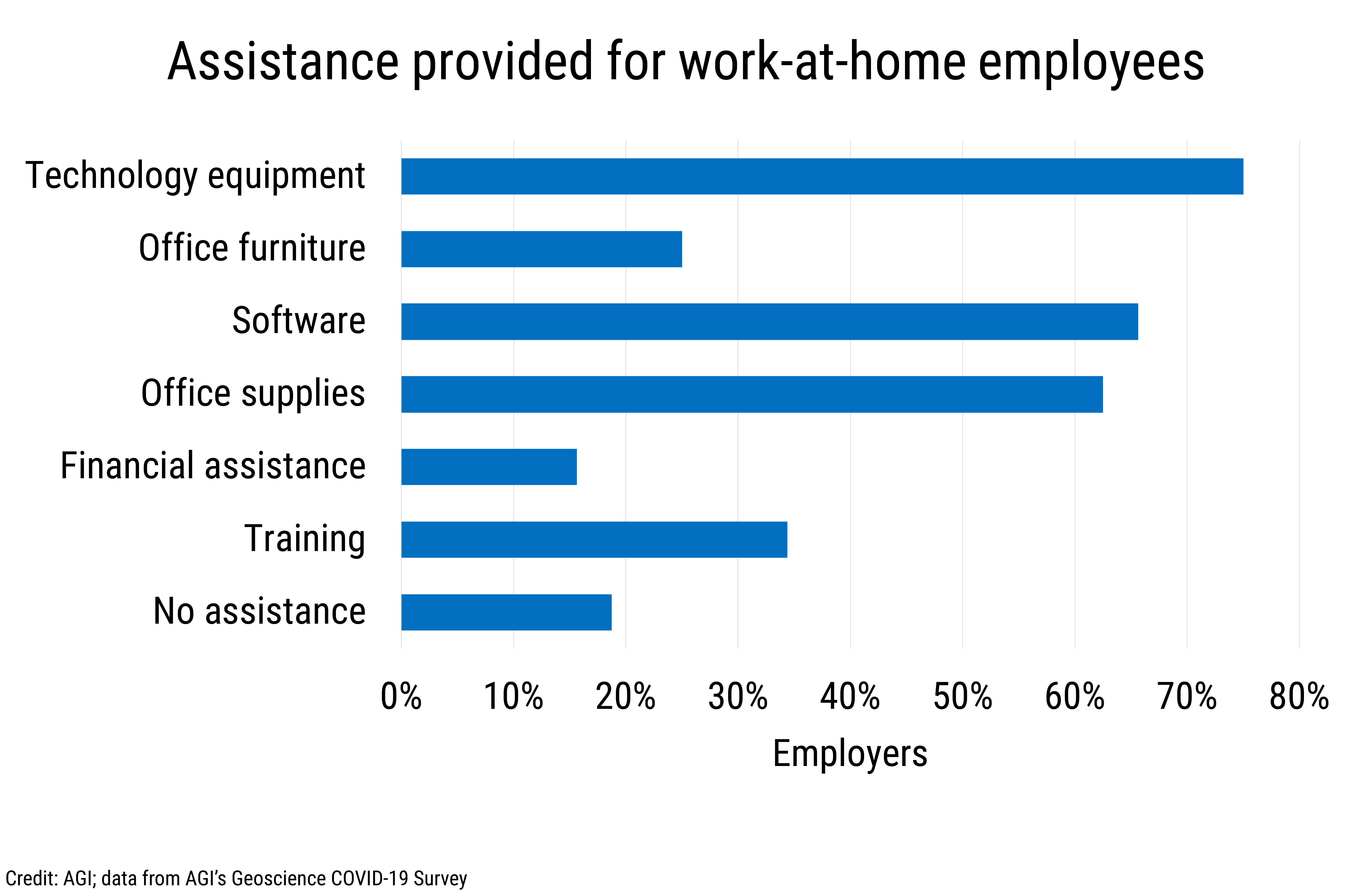

Over the duration of the pandemic, three-quarters of employers provided technology equipment such as computers, monitors, printers, software, office supplies, and furniture for employees who were working from home. While 16% of companies provided financial assistance for employees to set up their remote working environments, 19% of companies did not provide any assistance for employees who worked from home. Training on remote working technologies (i.e., using shared drives, setting up network and printer connections, cyber security, etc.) was provided by just over one-third of companies.

Note: Questions regarding re-evaluation of office policies were not asked in November 2021.

Hiring

The percentage of employers with active job openings ranged between 30% and 40% from late 2020 through the end of 2021, with a sharp increase in openings between October and December 2021. Hiring lagged job openings by a few months, with hiring peaking in June 2021 when 57% of employers reported hiring geoscience talent. Although hiring contracted in October, it grew again during the last months of 2021. By the end of 2021, over half of employers reported having job openings and half of employers reported making hires. Employers reported primarily hiring full-time geoscientists, with geoscience interns being hired during late Spring through the summer months.

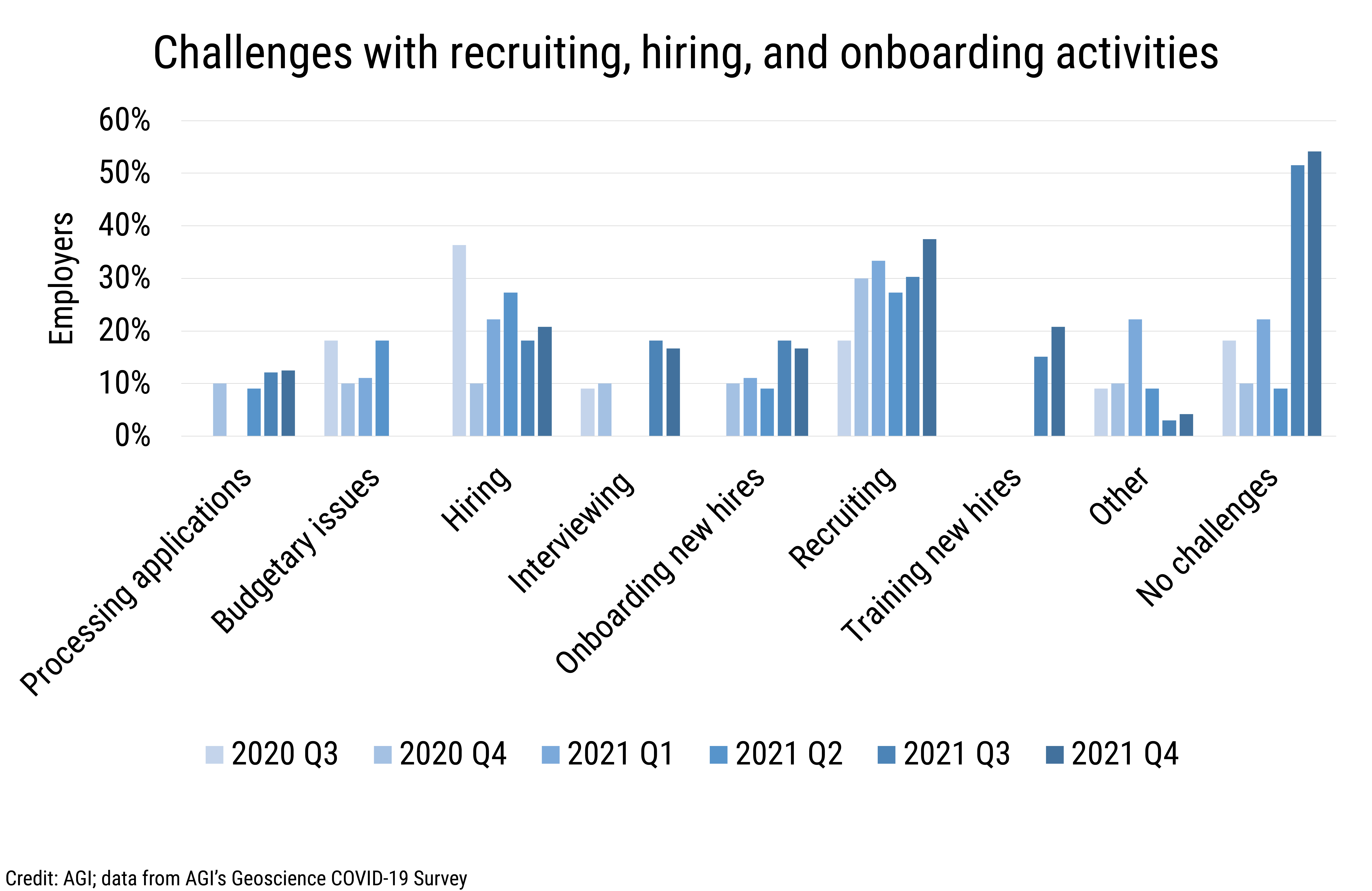

A worker shortage has been widely reported across the economy during 2021. The geosciences experienced this as well, especially through the first half of 2021. Beginning in July 2021, more than half of employers reported no challenges to recruiting, hiring, and onboarding activities. Recruitment continues to be a widely cited on-going challenge, with between 27% and 38% of employers citing a lack of available talent to fill vacancies. Onboarding new staff has also remained a challenge, especially into remote working environments, with employers shifting to virtual training for new hire training and onboarding. Funding and budget constraints related to hiring were more prevalent issues through the second quarter of 2021 than for the rest of the year.

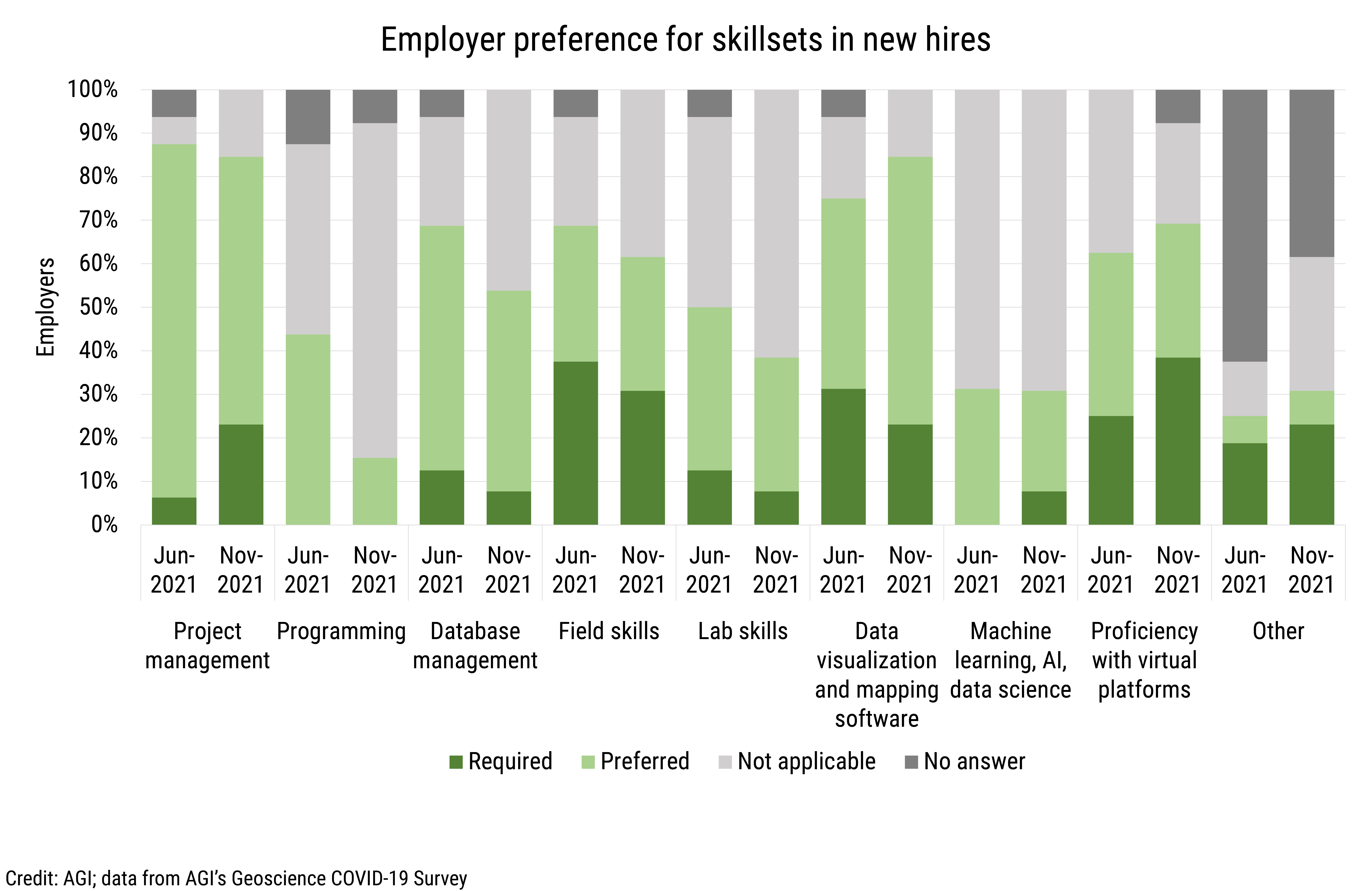

When asked about the skills and educational backgrounds of potential new hires, 86% of employers indicated they hired geoscience bachelor’s graduates, 81% hired geoscience master’s graduates, and 52% hired geoscience doctorates. The top skills required by employers were field skills, proficiency with virtual platforms, and data visualization and mapping software, with proficiency with virtual platforms increasing in importance between June and November 2021.

The top three preferred skills were project management, proficiency with data visualization and mapping software, and database management. Machine learning, artificial intelligence, and data science were of minor consideration by employers. Employers also commented that they looked for new hires that were motivated to learn and able to adapt to the requirements of the job as well as individuals with technical proficiency and practical experience. Nearly one-fifth of employers reported that they had changed what they were looking for in potential geoscience employees since the start of the pandemic, with most commenting on the need for candidates that had demonstrated they could work with minimal to no supervision.

Skills

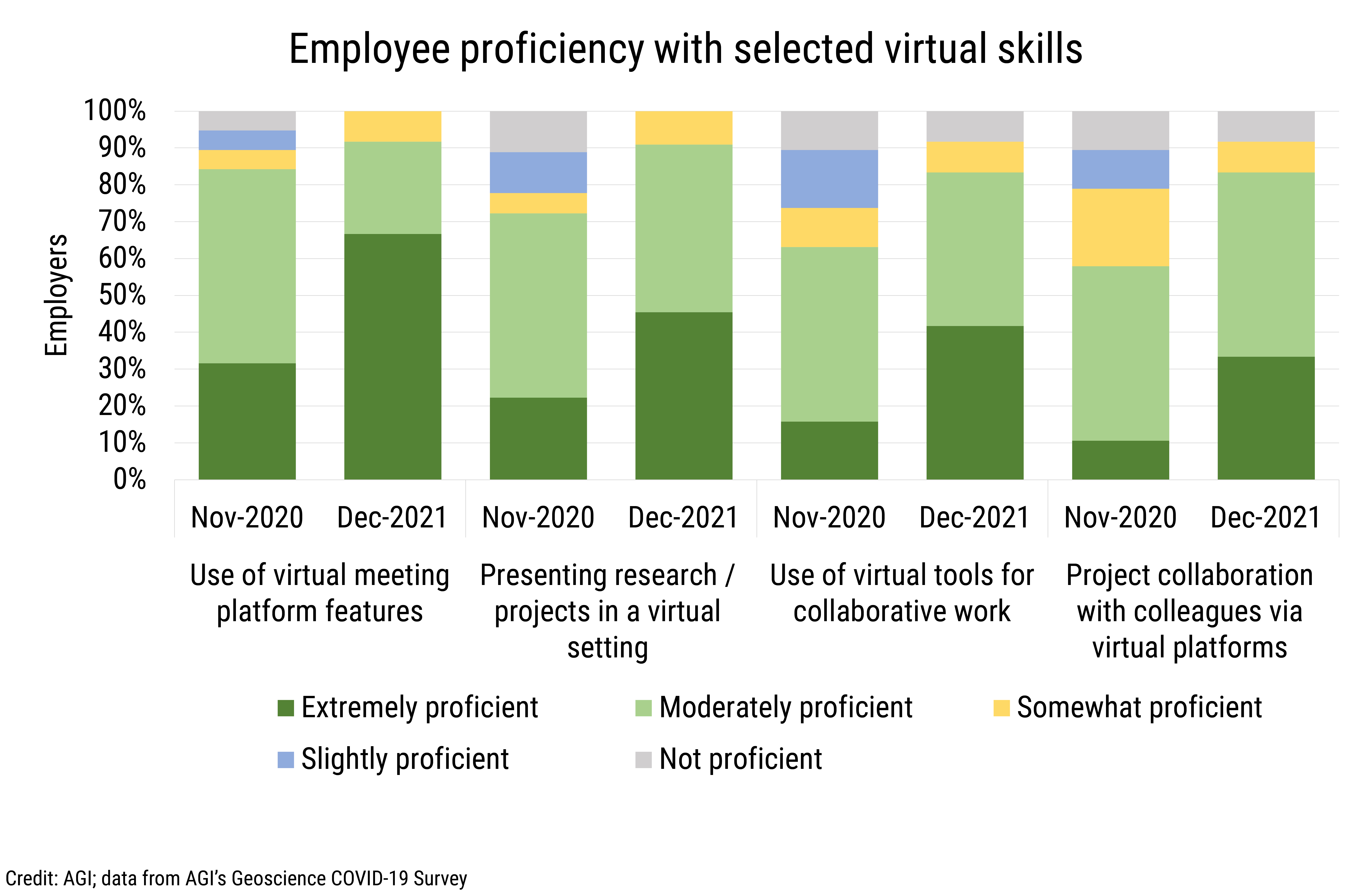

While most employers reported that their employees were moderately to extremely proficient with using virtual platforms and tools, they were less proficient with collaborating virtually on projects. Employers however have reported increased proficiency across all virtual skill categories between 2020 and 2021 with the greatest improvement seen project collaboration with colleagues. Approximately one-fifth of employers reported increased proficiency among their employees with the use of virtual tools for collaborative work and for presenting research and projects virtually.

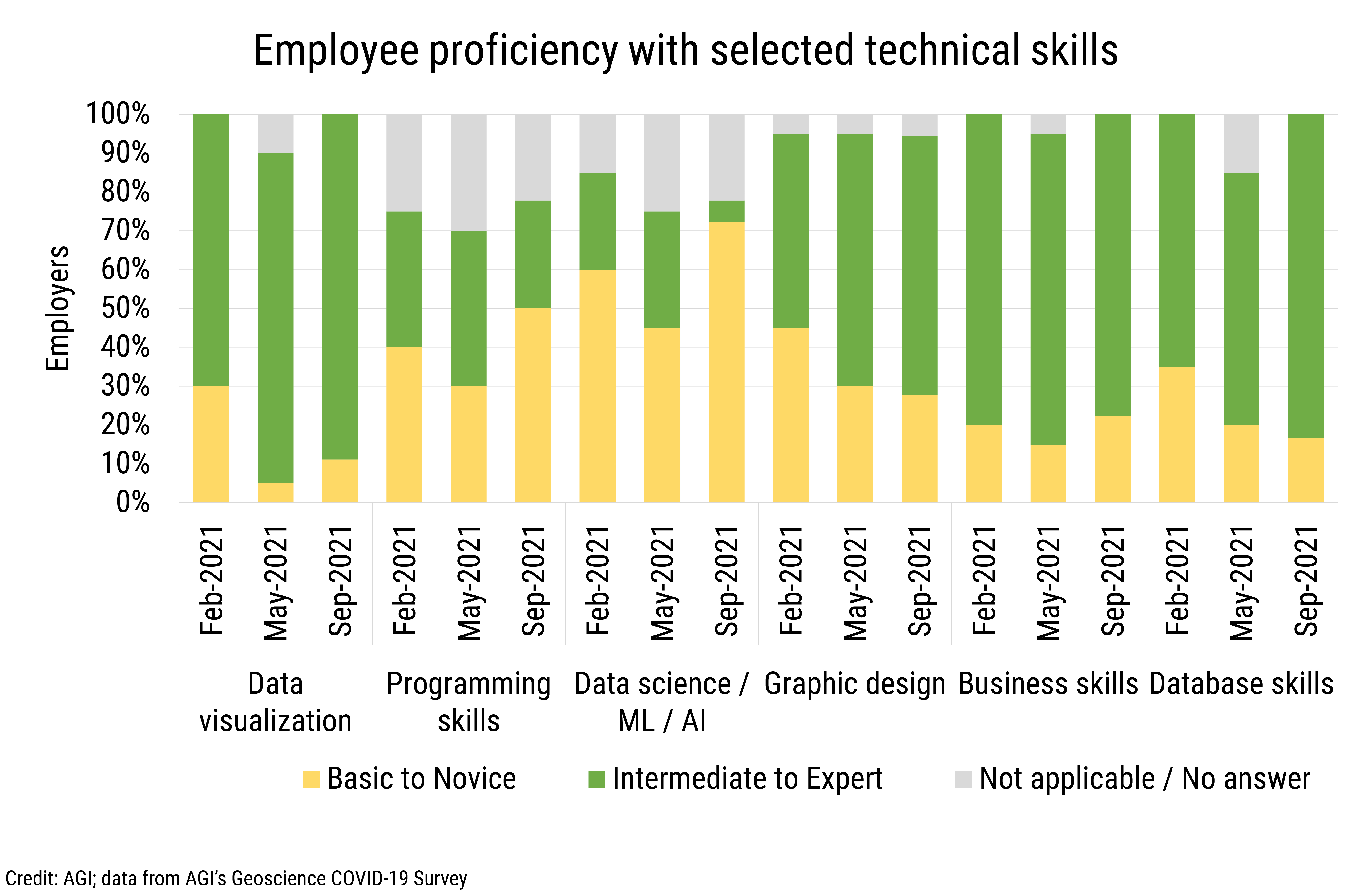

Employee proficiency with selected complementary technical skills such as data visualization, database skills, and graphic design showed the most improvement between February and September 2021, with nearly one-fifth of employers noting improvements at the intermediate to expert level across these categories. Approximately one-tenth of employers noted improvements at the basic to novice level for skills related to data science and programming between February and September 2021.

We will continue to provide current snapshots on the impacts of COVID-19 on the geoscience enterprise throughout the year. For more information about the study, please visit: www.americangeosciences.org/workforce/covid19

Funding for this project is provided by the National Science Foundation (Award #2029570). The results and interpretation of the survey are the views of the American Geosciences Institute and not those of the National Science Foundation.