Financial Performance

In 2021, geoscientist-employing organizations’ financial performance expectations shifted positively relative to 2020. In January 2021, nearly two-thirds of employers expected their financial performance for the year would be similar or higher than 2020, and by December 2021, 88% of employers reported the same. The percentage of employers reporting lower financial performance expectations relative to 2020 dropped from 36% to 12% between January and December 2021.

In February 2020, 76% of employers expected their financial performance for the year would be similar or higher than 2019. This sharply changed once the pandemic began with 50% or more of employers expecting worse financial performance through December 2020. Financial outlook improved markedly with the release of vaccine programs and economic reopening during 2021. During 2021, over half of employers expected their financial performance to be similar or higher than 2020 as well as than before the pandemic. By December 2021, 75% of employers reported they expected their financial performance level to improve relative to before the pandemic.

Productivity

Since June 2020, most employers have reported full or excess workloads relative to staffing levels. In 2021, the percentage of employers reporting excess workloads relative to staffing rose from 29% in January to 52% in December. For comparison, in 2020 the percentage of employers reporting excess workloads relative to staffing ranged from 25% to 37%. The percentage of employers reporting excess staffing capacity in 2021 declined from 44% in January to 24% in December, with the lowest percentages occurring in August and September (20% and 19%, respectively).

Financial Assistance

In July 2020, 44% of employers reported receiving some form of financial assistance, thereafter declining to 15% by the end of the year. Federal assistance was the primary type of aid received, followed by state and local aid, and then investment by business owners into their companies. In 2020, the primary form of aid received in July and August was federal assistance in the form of loans through the Paycheck Protection Program and Economic Injury Disaster Loans (EIDL). In 2021, aid from the American Rescue Plan boosted between 23% to 40% of employers from Spring through late Summer in the form of federal, state and local assistance.

Business Operations Impacts

Employers have increasingly reported no pandemic-related impacts to business operations since 2020, with two-thirds of employers reporting no pandemic-related impacts in December 2021. Impacts related to facility access restrictions eased by early Fall 2020, and by Summer 2021 less than one-fifth of employers reported restrictions. Termination or amendment of revenue generating contracts persisted as an issue through most of 2020 for over 40% of employers but declined through 2021. Supply chain disruptions, which were reported by nearly half of employers during Summer 2020, have persisted for at least 30% of employers through most of 2021.

The percentage of employers reporting supply shortages declined from 69% in 2020 to 54% by the end of 2021. In 2020, personal protective equipment was the most commonly reported supply shortage (62% of employers), and in 2021, IT supplies were the most commonly reported supply shortage (31% of employers). The percentage of employers reporting supply shortages edged up between mid and late-2021 for field supplies, lab supplies, IT supplies, office supplies, and other supply shortages.

Changes to Work Environments

With the shift to remote work environments, over half of employers reported reduced use of their office space. Three quarters of employers reported using multiple technology platforms for conducting work, with Zoom and Microsoft Teams being the most commonly reported platforms in use (81% and 65% of employers respectively).

When asked about benefits to work and research during the pandemic, over half of employers noted improved use of virtual platforms as well as benefits to employees such as reduction in work commutes and flexibility in work locations. In addition, over 40% of employers noted reduced work-related expenses, reduced active usage of office spaces, and flexibility in work hours for employees as benefits. It is interesting to note that despite the improved use of virtual platforms and flexibility in work location and hours noted by employers, lack of scheduling conflicts and improved employee retention was not noted by employers as benefits related to current work and research formats.

Despite the benefits from the way work and research has been conducted during the pandemic, lack of in-person interactions has been the most frequently reported challenge, with 79% of employers noting this issue. In addition, over one-third of employers reported challenges related to collaboration, less effective communication, and concerns related to health and safety.

Strategies and Concerns

Strategies for dealing with pandemic-related impacts have primarily been focused on investments in remote work resources and implementation of health and safety protocols for those working in facilities, offices, and at field sites. Other strategies noted by employers included more flexibility in working environments, increased automation in business operations, and prioritizing work to maintain operations and production.

Since 2020, pandemic-driven concerns of employers have decreased across all categories except those related to supply chain disruptions. In December 2021, 38% of employers noted supply chain concerns driven by the pandemic. Meanwhile, the percentage of employers noting concerns related to workplace safety, which has been a major concern for most of the pandemic, declined from 52% in February 2021 to 31% in December 2021.

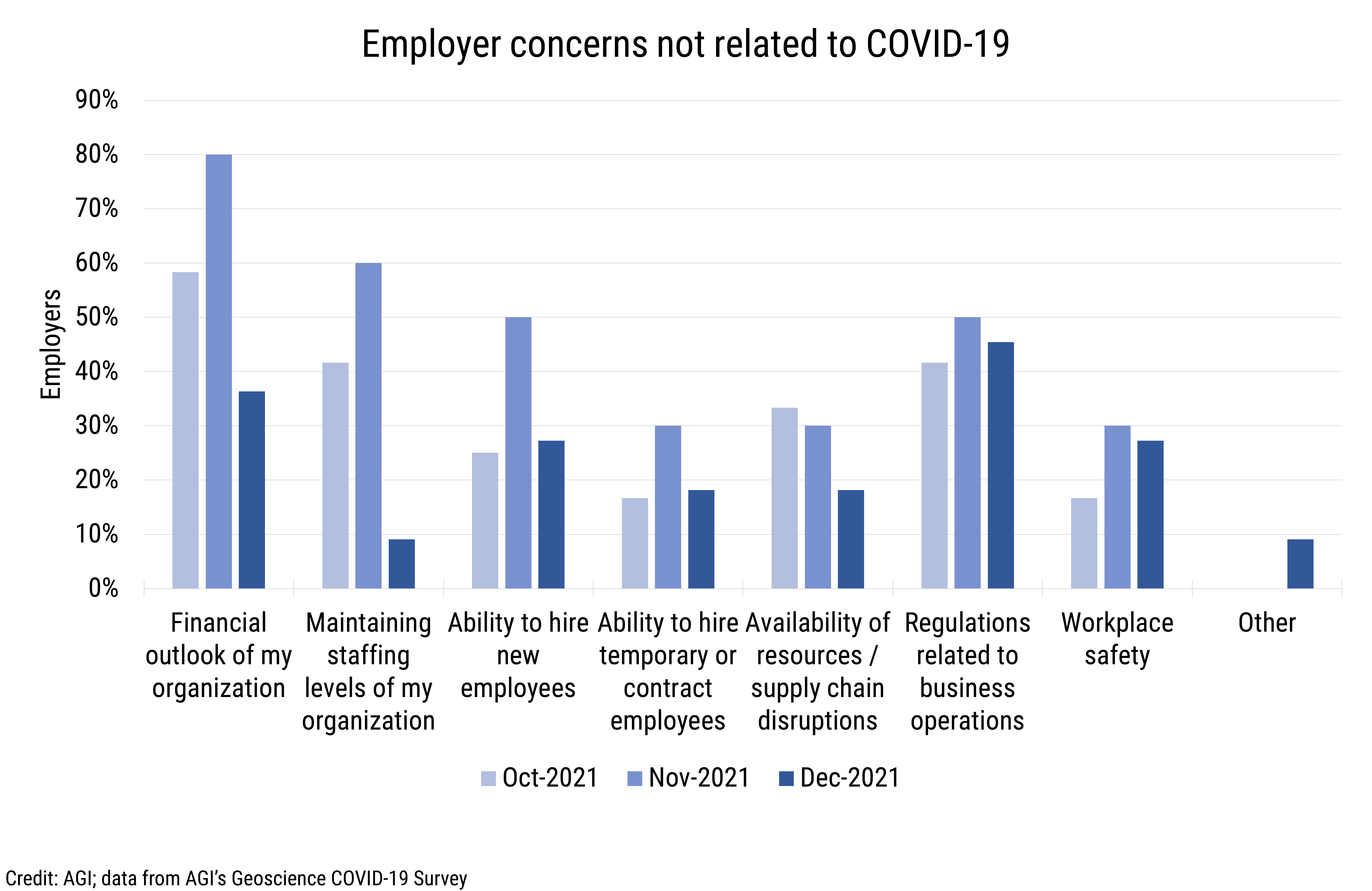

In October 2021, we began asking about non-pandemic concerns to ascertain other issues that have begun to arise as the pandemic continues. While the percentage of employers reporting non-pandemic related concerns peaked in November 2021, there was a general decline across most concerns since then, except for business operations regulations and workplace safety. We will continue to monitor non-pandemic related concerns in the coming months.

We will continue to provide current snapshots on the impacts of COVID-19 on the geoscience enterprise throughout the year. For more information about the study, please visit: www.americangeosciences.org/workforce/covid19

Funding for this project is provided by the National Science Foundation (Award #2029570). The results and interpretation of the survey are the views of the American Geosciences Institute and not those of the National Science Foundation.